The executives & politicians that run USDC & USDT have total control over future Ethereum hard forks.

When a fork occurs, stablecoin issuers will only follow one path. Not both.

DeFi on the path they abandon will suffer an apocalyptic death, rendering the chain uninhabitable.

If an infrastructure layer is critical, diversity of clients is a must.

For stablecoins, 87% of the market = controlled by 2 companies.

This dual point of failure poses a systemic risk.

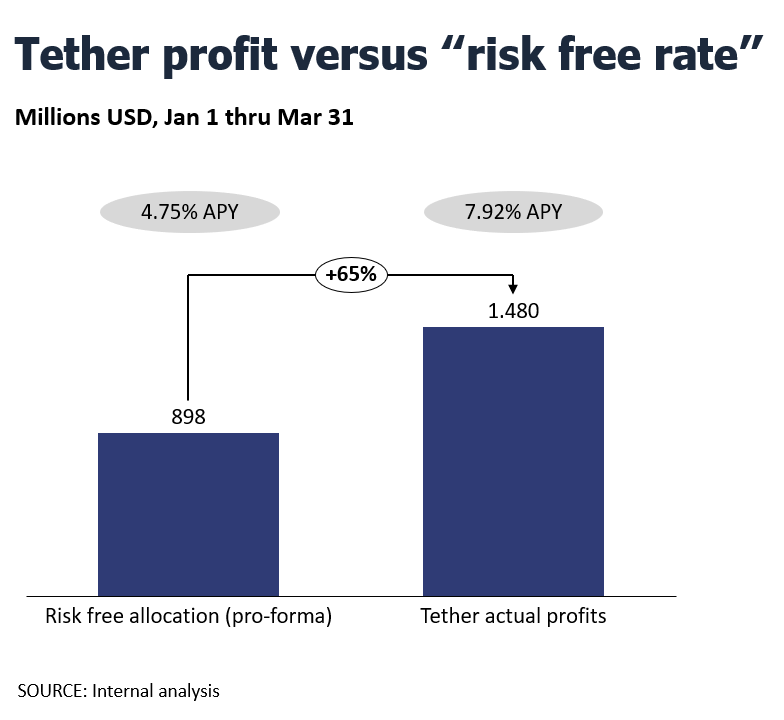

Tether's 1.48B profit equates to a 7.9%APY

This is 67% higher than the risk-free rate.

The 7.92% APY alone should already ring some bells!

Most likely the extra return is associated to risk.

Risk that is taken by the depositor.

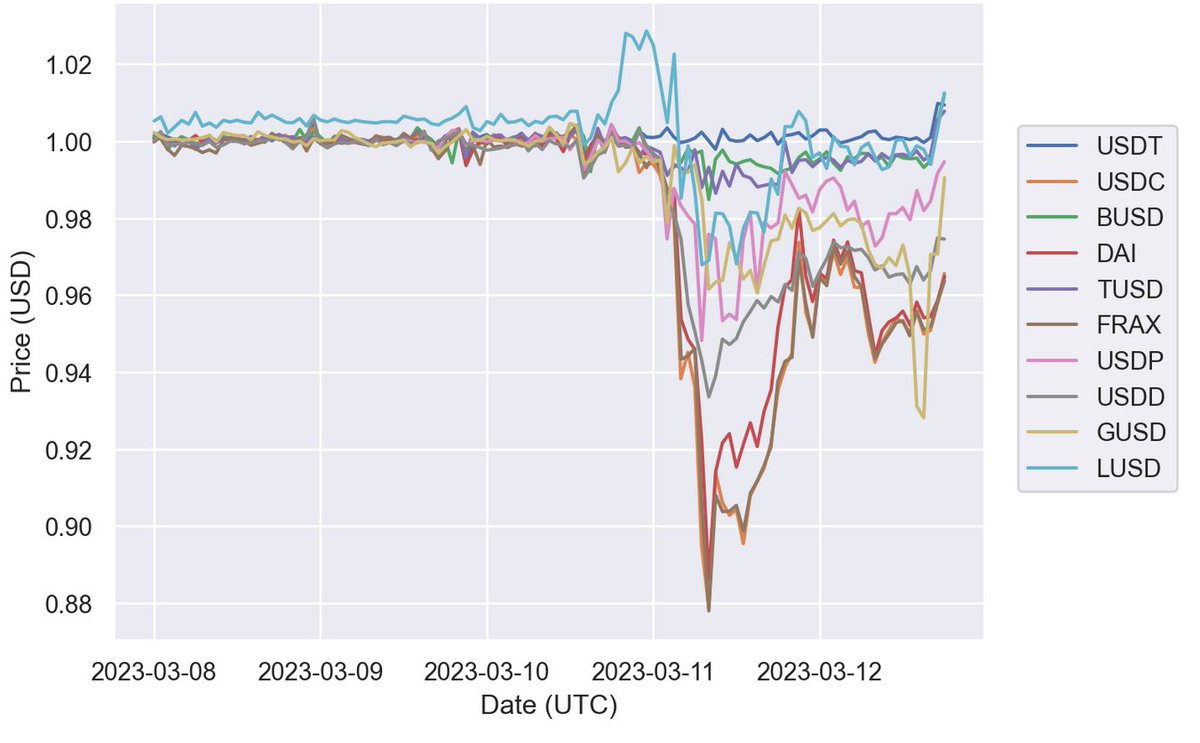

Here's what the aftermath of the SVB collapse reveals about stablecoins:

forbes.com/sites/digital-assets/2023/03/13/svb-banking-crisis-shows-usdc-stablecoin-is-still-wildly-unstable

7 of the largest 10 stablecoins depegged as a massive bank run effect rippled across crypto

What happened and what are the lessons for the space: 🧵👇

Ethereum co-founder Vitalik Buterin says that centralized stablecoins like Circle's USDC have the potential to become “significant deciders” in future "contentious" hard forks. cointelegraph.com/news/vitalik-centralized-usdc-could-decide-the-future-of-contentious-eth-hard-forks

#xrpcommunity

Will Circle And Tether Reign Supreme? Federal Reserve Predicts Stablecoin Issuer Duopoly via @forbes forbes.com/sites/jasonbrett/2022/02/19/will-circle-and-tether-reign-supreme-federal-reserve-predicts-stablecoin-issuer-duopoly

I wrote about how stablecoin diversity is a good thing, and some thoughts on next iterations

medium.com/@kirkhutchison/let-a-thousand-stablecoins-bloom-ae01aaf15a73